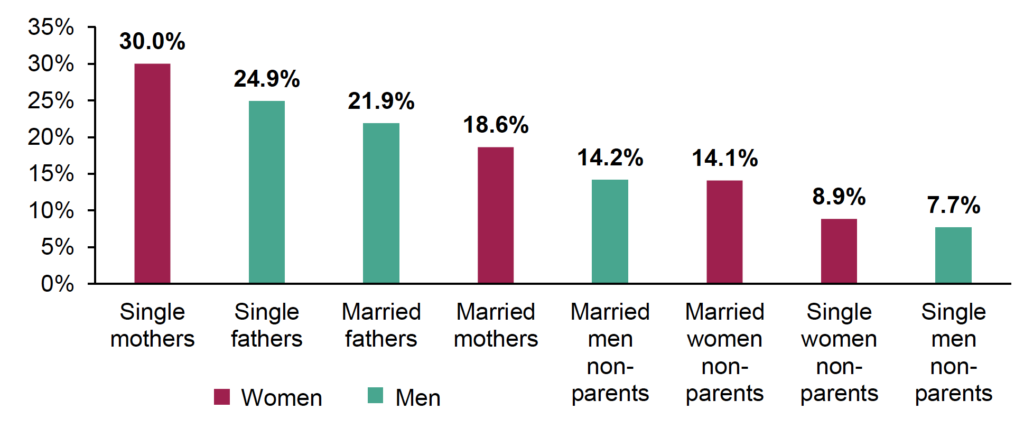

Analysis of the 2011-12 National Postsecondary Student Aid Study data by the Institute for Women’s Policy Research (IWPR) finds that three in ten single mothers in college attend private, for-profit schools, a larger share than students of any other family type (Figure 1).[1] At for-profit institutions, single mothers account for 26 percent of the student body, yet they are only 11 percent of all undergraduate students.[2] College students who are parents of dependent children are more likely than their counterparts without children to attend for-profit institutions, and single parents are more likely than married parents to attend a for-profit school (Figure 1).

Figure 1: Share of Undergraduate Students Enrolled in Private, For-Profit Educational Institutions by Parent and Marital Status, 2011-12

Note: Single includes those who are divorced, widowed, or separated. Parents include undergraduate students with dependent children. Source: IWPR analysis of data from the U.S. Department of Education, National Center for Education Statistics, 2011-12 National Postsecondary Student Aid Study (NPSAS:12).

For-profit schools specifically recruit and enroll single parents, people of color, and low-income students who are often especially unlikely to be able to afford college.[3] Single mothers in college are much more likely to live below the poverty line, and parents incur more debt than other students.[4] Tuition at for-profits is significantly higher than at public institutions. Over 70 percent of students at for-profit schools take out federal loans, compared with 17 percent at public two-year and 48 percent at public four-year institutions. For-profit students graduate with higher debt than graduates of non-profit schools.[5] Single mothers have disproportionately high loan default rates;[6] attending a for-profit institution increases their financial risk.

Although higher education is an important avenue for achieving economic stability, for single mothers who turn to for-profit institutions, their time and investment may not pay off. Only slightly more than one-quarter of students at for-profit schools complete their program within six years, and those who do graduate may find that their degree does not translate into a job or higher earnings.[7] The small share of single mothers who complete their degrees at for-profit schools are likely to face a gender pay gap upon graduation.[8] Those who do not earn a degree, who earn a degree that does not lead to a living-wage job, or who incur significant debt miss an important opportunity to support their family and establish economic stability.

Regulations such as the gainful employment and borrower defense rules that ensure transparency and accountability for educational programs and offer loan forgiveness options to students who were defrauded by their institutions provide important safeguards for college students, and especially single student mothers.[9]

Notes

[1] IWPR analysis of data from the U.S. Department of Education, National Center for Education Statistics, 2011-12 National Postsecondary Student Aid Study (NPSAS:12).

[2] IWPR analysis of data from the U.S. Department of Education, National Center for Education Statistics, 2012 Integrated Postsecondary Education Data System (IPEDS) and the 2011-12 NPSAS.

[3] For the recruitment practices of for-profit institutions, see Tressie McMillan Cottom. 2017. Lower Ed: The Troubling Rise of For-Profit Colleges in the New Economy. The New Press. For the 2014-15 academic year, tuition and fees were estimated at $6,371 at public institutions and $13,971 at private, for-profit institutions; data are from the U.S. Department of Education, National Center for Education Statistics. 2016. “Postsecondary Education.” Table 330.10 in Digest of Education Statistics: 2015. <https://nces.ed.gov/programs/digest/d15/ch_3.asp> (accessed August 2, 2017).

[4] See Barbara Gault, Lindsey Reichlin, and Stephanie Román. 2014. College Affordability for Low-Income Adults: Improving Returns on Investment for Families and Society. Report, IWPR #C412. Washington, DC: Institute for Women’s Policy Research. <https://iwpr.org/publications/pubs/college-affordability-for-low-income-adults-improving-returns-on-investment-for-families-and-society/> (accessed February 19, 2016).

[5] The share of students at for-profit schools taking out federal and non-federal loans is IWPR analysis of data from the 2011-12 NPSAS. For the amount of debt incurred by graduates of for-profit schools, see The Institute for College Access & Success. 2014. “Quick Facts About Student Debt.” <http://ticas.org/sites/default/files/pub_files/Debt_Facts_and_Sources.pdf> (accessed August 4, 2017).

[6] See Melanie Kruvelis, Lindsey Reichlin Cruse, and Barbara Gault. Forthcoming. Single Mothers in College: Growing Enrollment, Financial Challenges, and the Benefits of Attainment. Briefing Paper. Washington, DC: Institute for Women’s Policy Research.

[7] The six-year graduation rate for the 2008 cohort was 27 percent at private, for-profit institutions, 58 percent at public institutions, and 65 percent at private, non-profit institutions; data are IWPR analysis of 2011-12 NPSAS. Another study found that six years after enrolling, students at for-profit schools had higher unemployment and lower earnings than comparable students attending other types of educational institutions; see David J. Deming, Claudia Goldin, and Lawrence F. Katz. 2012. The For-Profit Postsecondary School Sector: Nimble Critters or Agile Predators? New York, NY: Center for Analysis of Postsecondary Education and Employment. <http://capseecenter.org/wp-content/uploads/2016/07/ForProfit_Nimble-Critters_Feb-2012.pdf> (accessed August 4, 2017).

[8] See Barbara Gault, Lindsey Reichlin, and Stephanie Román. 2014. College Affordability for Low-Income Adults: Improving Returns on Investment for Families and Society. Report, IWPR #C412. Washington, DC: Institute for Women’s Policy Research. <https://iwpr.org/publications/pubs/college-affordability-for-low-income-adults-improving-returns-on-investment-for-families-and-society/> (accessed February 19, 2016).

[9] The gainful employment rule requires educational programs to report the ratio of graduates’ debt to their income; those with high debt-to-income ratios can be denied federal financial aid (see U.S. Department of Education 2015). “Obama Administration Increases Accountability for Low-Performing For-Profit Institutions.” <https://www.ed.gov/news/press-releases/fact-sheet-obama-administration-increases-accountability-low-performing-profit-institutions> (accessed August 11, 2017). Borrower defense established a process for students to seek loan forgiveness if they were defrauded or deceived by a higher education institution; see U.S. Department of Education. 2016. “Education Department Proposes New Regulations to Protect Students and Taxpayers from Predatory Institutions.” <https://www.ed.gov/news/press-releases/education-department-proposes-new-regulations-protect-students-and-taxpayers-predatory-institutions> (accessed August 11, 2017).

This Quick Figure was funded with generous support from the ECMC Foundation as a part of a larger project on the costs and benefits of increasing educational attainment among single mothers. It was prepared by Julie Anderson, M.A., Lindsey Reichlin, M.A., and Barbara Gault, Ph.D. at the Institute for Women’s Policy Research.